This story originally appeared in The 19th and is republished with permission under a Creative Commons license. Subscribe to The 19th’s newsletter here.

In the lead up to Election Day, presidential candidates had big ambitions for the future of the child tax credit, which is set to expire next year. That looming deadline means Congress will have to take up the credit in 2025, deciding whether to let it lapse, lock it in as is, or expand it further. But despite what had been proposed on the campaign trail, there is unlikely to be a major expansion coming to one of the most popular policies for American families.

During the election cycle, candidates were proposing expansions that would have doubled and tripled the existing tax credit, from the $2,000 it is today to as much as $5,000 or $6,000. But the feasibility of those proposals is now being tested.

In 2021, a one-time change to the child tax credit showed what was possible if it was significantly expanded. In the wake of the pandemic, the credit went up so that families received at least $3,000 per child and as much as $3,600 if they had kids under 6. The credit also came via monthly checks to households, instead of one annual lump sum.

And, critically, it was expanded so that the poorest families qualified for the first time. The impacts were immediate: Child poverty was cut in half, to 5.2%. But that expansion expired in 2022 and the credit went back to $2,000 — 18 million kids became ineligible again, most of them children of color. The child poverty rate also rose back up to 12.4%. Today, it stands at 13.7%.

Both versions of the credit show the different paths Congress could take next year, and those conversations are already beginning, according to several advocates lobbying for the credit.

Republicans will go into the negotiations with control of the White House, the House of Representatives, and the Senate, which means they can “fast-track legislation,” said Meredith Dodson, the senior director of public policy for the Coalition on Human Needs. She said early conversations indicate members of Congress are working to iron out details of what could be in the tax package so they can get started as soon as a new Congress is sworn in.

In 2017, Trump’s Tax Cuts and Jobs Act raised the child tax credit amount from $1,000 to $2,000 and made it available to families earning up to $400,000, instead of those earning up to $110,000. But at least 20% of the poorest children still didn’t receive any or most of the credit because their parents earn too little to pay income taxes. That’s how the tax credit has been structured since it was introduced in 1997.

At minimum, it’s likely the credit will not be allowed to expire, which would return it to $1,000 per child and cut more higher-income families out of the benefit, experts told The 19th. The current Republican platform outlines a goal of making the 2017 expansion permanent, which makes the possibility of the credit just remaining as it is now the most probable starting point.

It’s possible the credit could be indexed to inflation so that it retains its value over time. A proposal in Congress this year would have done just that, as well as make other modest changes to the tax credit. Three-quarters of House Republicans supported it, but ultimately the bill failed because Senate Republicans opposed some parts of the plan.

Historically, Republicans have opposed any provisions that they view as disincentivizing work. One of the most hotly contested components of the child tax credit proposal from earlier this year was a provision that would allow people to use their prior year’s income to qualify for a larger credit, which would allow caregivers who are not working this year to still claim the money. Proposals for increasing the dollar amount of the child tax credit may also lead parents to reduce their work hours, Republicans have argued. But proponents say that money instead aids parents in paying for child care or other needs, which is how much of the 2021 expansion dollars were used by families, at least in the short term.

All of that shapes the kind of child tax credit changes that Republicans may now consider. Sen. Chuck Grassley, who sits on the influential Senate Finance Committee and was one of the Republicans who voted against the expansion proposed this year, has been supportive of an approach that would index the credit to inflation, for example.

Dodson said there is “a lot of interest” in indexing the credit to inflation, making that one of the most likely changes that could be on the table next year. If the credit stays at $2,000, that would mean it would be worth less today than it did in 2017. Indexing it to inflation would raise the credit to around $2,500.

Still, that approach would continue to leave out about 18 million children who would still not be eligible.

“We can still sometimes see a real disconnect between what families are saying they need, what the evidence shows, and then what actually ends up happening. The details really matter,” said Megan Curran, the policy director at Columbia’s Center on Poverty and Social Policy, which has done much of the research and analysis on the child tax credit. “What the child tax credit has the potential to do, and that we have seen that it has done in very recent history — that’s a different child tax credit from what we have on the books and what is the baseline on the books for negotiation in 2025.”

The best evidence that some in the new administration would consider going a more ambitious route has come from Vice President-elect J.D. Vance, who said on the campaign trail he would support a $5,000 child tax credit for “all” families. No further details were released and the definition of “all” could be immensely consequential if it meant making the credit universal.

Trump himself has said far less on the credit, but he has at least indicated that he does “support it and I want to have it.” In an interview with CBS News, he alluded to there being two to three variations of the child tax credit on the table, but those details have not been released. A campaign official told Semafor in August that Trump “will consider a significant expansion.”

The Trump transition team did not respond to multiple requests for comment to clarify what kind of expansion the president-elect might push.

Still, two of the biggest Republican child tax credit champions are also leaving Congress — Utah Sen. Mitt Romney is retiring, and Florida Sen. Marco Rubio has been tapped to lead the State Department.

Also in the mix is how Republicans plan to pay for any extensions of the 2017 tax provisions. To offset some of the costs, Republicans said last week they are considering making cuts to Medicaid and food stamps. That may be unlikely if it alienates moderate Republicans who oppose that approach in the House where the GOP only has a slim majority, said Michelle Dallafior, the senior vice president for budget and tax at First Focus Campaign for Children, a bipartisan advocacy organization. Some of the proposals on the table would create new work requirements and spending caps on the programs, impacting some 70 million low-income people.

“If the approach they take on this is to pay for some of these tax cuts and to pay for them with things that cause a lot of pain to kids and families, communities and people most in need, they start losing votes and they don’t have many to lose in either chamber,” Dallafior said.

If Republicans do choose to consider a broader child tax credit expansion, one place they might look is at some form of “baby bonus” for very young children. During the campaign, Vice President Kamala Harris proposed a $6,000 bonus for families during the first year of a child’s life, when costs are highest.

Others have also supported versions of that idea, including various conservative groups that signed on to a memo outlining their view for what form the credit should take. They support raising the amount to $3,000 and adding a $2,000 credit for families with newborns.

The groups argue it is one of the best ways to signal support for families who choose to have children, particularly at a time of falling fertility rates and after the Supreme Court’s Dobbs v. Jackson Women’s Health Organization decision, which overturned Roe v. Wade.

“In a post-Dobbs, low birth rate, high deficit environment, a baby bonus will give the biggest political and cultural bang for the buck, and thus should be prioritized accordingly,” wrote Patrick T. Brown, a fellow at the conservative think tank the Ethics and Public Policy Center.

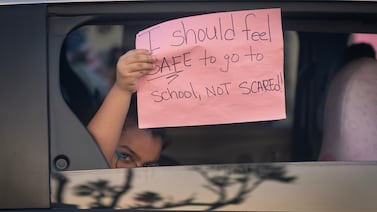

As politicians decide where they land, parents like Tia Simmons are stepping up their advocacy efforts.

Simmons is part of the Automatic Benefit for Children Coalition parent advisory board, a group of about a dozen parents who are working to lobby Congress on the child tax credit. She joined the coalition earlier this year after being cut out of the 2021 expansion because of an issue with child custody payments for a child she put up for adoption nearly two decades prior. Simmons has a 3-year-old and a 4-year-old, and cares for her 9-year-old niece. If she had received the credit in 2021 for all three, it would have amounted to about $900 a month that year — nearly enough to cover her mortgage payment.

“It made me realize that I can’t be the only one who has small kids who are not getting credit for whatever reason,” she said. “These kids are missing out on the money, not the parents.”

The coalition is advocating for a universal child tax credit — available to all kids no matter how much their parents earn — that is at least $6,000 a year.

“It needs to be something that is enough that it can be helpful,” Simmons said. “So many of the times you get SNAP or housing assistance that just isn’t enough.”

Child care alone, for example, cost families between $6,500 and $15,600 for just one child in full-time care in 2022, the most recent year data is available from the Department of Labor.

Simmons is now in her third year of law school and still struggling to support three children. She hasn’t received the tax credit for her niece in recent years because the way the credit is structured, the money goes to the person who claims the child as a dependent in their tax returns, not necessarily the one doing the caregiving. It’s all those small policy decisions that will be before Congress, and she wants to remind members that each decision could have a big impact on individuals’ lives.

“While they’re in Congress arguing about it and to determine whether or not it’s going to make us quit our jobs, we are out here with no incomes, struggling to make ends meet — their attitudes about it are totally wrong,” Simmons said. “Every month we worry: ‘Is there going to be a gas cut-off notice? Do we have to pick between buying Christmas gifts for our kids?’ So these things are real. There are real families who need this funding, and that’s what we want them to know the most: We are here and we are struggling, and we need these funds to come in and it might seem removed from them, but it’s our reality.”