Colorado voters face an important education decision this November: whether to approve a major statewide tax increase for schools. This request represents the third time in recent years that Colorado voters have been asked to put more money into schools.

The last two times, they gave a resounding no. Amendment 73 comes on the heels of teacher protests here and around the nation that have raised awareness of low pay and other unmet classroom needs.

Proponents of the measure say Colorado schools can’t keep doing more with less and need new revenue to do right by students. Opponents say that raising taxes will hurt the state’s economic prosperity without necessarily improving student outcomes.

Here’s what you need to know to make a decision:

What does Amendment 73 do?

This measure would create a graduated income tax for people earning more than $150,000 a year and would raise the state corporate tax rate. It also would change the assessment rate — the portion of your property value that is taxed — for commercial and residential property.

Altogether, these changes are projected to raise an additional $1.6 billion a year for preschool through 12th-grade education. That’s in addition to the roughly $9.7 billion in federal, state, and local money that Colorado will spend this year on schools.

The amendment raises the base amount Colorado is required to spend on each student, and it also dedicates money to preschool spots, full-day kindergarten, students with disabilities, those learning English, and those identified as gifted and talented.

Why is this on the ballot?

Colorado’s Taxpayer’s Bill of Rights requires that all tax increases be approved by voters. As for this particular tax increase, Colorado funds its schools below the national average, and since the Great Recession, state lawmakers have diverted to other areas billions of dollars constitutionally due to education.

Proponents of the measure believe the only way to adequately fund Colorado schools is to tap into an additional revenue source, like these tax increases.

Opponents counter that administrative spending has grown faster than student population and teacher salaries, and that the state and school districts could free up money for classrooms by setting new priorities.

I see amendments and propositions on my ballot. What’s the difference?

Propositions become laws and can be changed by the legislature. Amendments become part of the state constitution and can only be changed by another vote of the people. Amendments need the approval of 55 percent of voters to pass, a higher bar than propositions that only require a simple majority.

How will the money be spent? What guarantees do we have that it will reach the classroom?

Amendment 73 requires that new money “supplement and not supplant” existing funding. That means the legislature cannot redirect current spending on education and replace it with this new funding source. The amendment says the legislature should adopt a new formula for distributing money to districts that takes into account student and district characteristics, but it doesn’t lay out exactly what that should look like.

In the meantime, Amendment 73 describes specific uses for $866 million in new revenue:

- Base spending per student will go up from $6,769 to $7,300, a 7.8 percent increase

- Funding for full-day kindergarten. Right now, districts get a little more than half a student’s worth of funding for each kindergarten student.

- An 8.3 percent increase for preschoool, bringing the total to $131 million

- A 68 percent increase for special education, bringing the total to $296.1 million

- An 80 percent increase for gifted and talented programs, bringing the total to $22.5 million

- A 93 percent increase for English language learners, bringing the total to $41.6 million

The extra money that districts currently receive for students with disabilities, those learning English and those identified as gifted accounts for a fraction of the additional cost of educating them, particularly in the case of students with more significant disabilities. Districts have to use tracking codes to account for this money and ensure it goes to its intended purpose. In some districts, additional money might translate into better services for these students, while others might use the additional dedicated funding to free up other money.

That leaves $738.6 million that can be spent on public education as determined by the legislature. Once that money lands in school district coffers, they have broad discretion over how to spend it. This is by design and part of an effort to get buy-in from around the state. Many school boards have passed non-binding resolutions promising to spend the money on teacher pay, more mental health supports for students, and lower class sizes.

In turn, opponents have criticized the lack of specificity as a blank check that won’t necessarily increase teacher salaries or improve student outcomes.

A recent analysis from EdChoice found that since 1992, teacher salaries in Colorado had fallen even as per-student funding and the number of administrators had increased. Colorado Department of Education records show that instructional staff — teachers, counselors, speech language pathologists, school nurses — increased by 14 percent between 2006 and 2016 while administrative staff increased by 34 percent. However, when Denver Public Schools, the state’s largest district, is removed, administrative positions have gone up only 23 percent in the rest of the state.

Because A different way of looking at this would be the ratio of administrators to instructional staff. In 2006-7, there were 13 administrators for every front-line position; in 2016-17, there were 11. Those positions include direct managers and supervisors who tend to earn modest salaries.

School administrators argue these positions are necessary to support the work that teachers do and keep districts in compliance with a host of new state and federal regulations. In smaller districts, administrators often wear multiple hats. When we ask teachers about this issue, some of them share the concern that too much money gets spent on central administration, even as they also believe schools need more money overall.

You can look up how much your district spends here.

What does it mean when people say Colorado schools are ‘underfunded’? Compared to what? How underfunded?

There are several different ways to look at this. The National Education Association, the country’s largest teachers union, ranks Colorado 28th in per pupil spending when state, local, and federal money is combined and puts Colorado about $758 per student below the national average. Education Week does a more complex ranking that takes into account regional cost differences and puts Colorado nearly $2,800 below the national average. Colorado teacher salaries are among the least competitive in the nation, making it hard to recruit and retain educators. More than 100 of Colorado’s 178 school districts operate on four-day weeks.

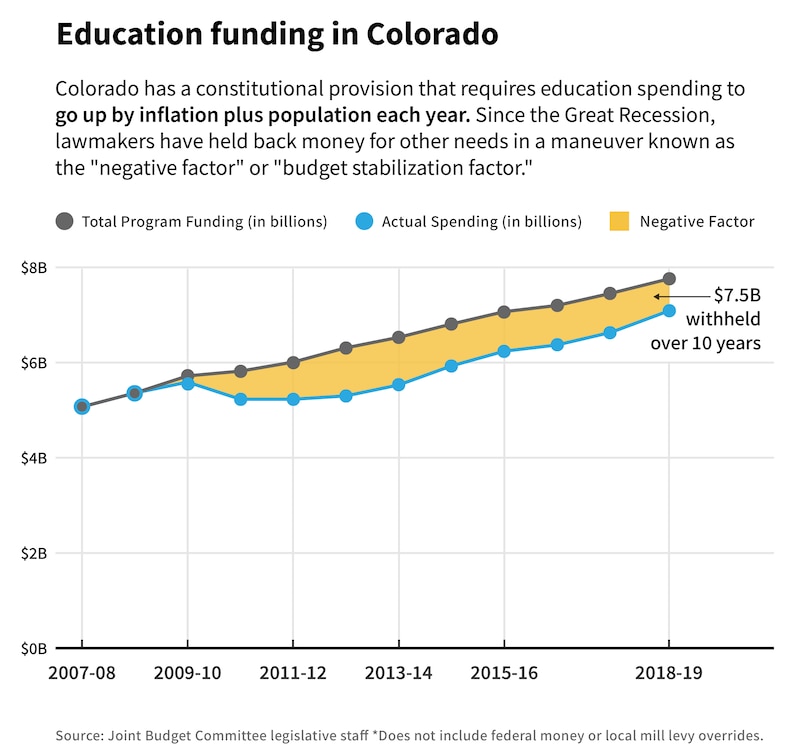

Back in 2000, after previous years of budget cuts, Colorado voters passed a constitutional amendment that requires school funding to increase by population plus inflation. But starting with the Great Recession, Colorado lawmakers have not allocated all the money required by that amendment. Over the past 10 years, Colorado schools have missed out on $7.5 billion the law requires them to receive. The courts have upheld this budget maneuver. Money from Amendment 73 could not be reallocated during the next downturn, protecting schools but potentially creating other budget problems for the state.

Colorado also gets low marks on equity. Colorado spends much less money on education than most states with similar levels of wealth and economic activity. Per-student spending varies widely around the state, with rich districts often getting more state money than poor ones. Some districts have convinced voters to approve local property tax increases, while other have not — or have such low tax bases that voters would need to take on large increases to generate much benefit. The additional funding from these local tax increases varies from $32 to $5,024 per student.

Amendment 73 wouldn’t change these structural problems with school funding. It would give state lawmakers more money with which to level the playing field. Right now, sending more money to some districts would require reducing funding to others, creating a political minefield.

Will I pay more in income taxes if Amendment 73 passes?

People who earn up to $150,000 a year will keep paying the same 4.63 percent state income tax rate they do now. Those earning more will pay a sliding increase starting at 5 percent for income from $150,001 to $200,000 up to 8.25 percent for income over $500,000. Someone with taxable income of $200,000 would pay an extra $185 a year, while someone with $1 million in taxable income would pay an extra $24,395, according to a fiscal analysis by the state.

The increases will affect about 8 percent of individual and joint income tax filers. Amendment 73 does not include a provision to adjust the income threshold for inflation, so it’s possible that more taxpayers will pay these higher rates in the future.

This change would generate most of the new revenue under Amendment 73.

What’s the effect on corporate taxes?

Amendment 73 would raise the corporate income tax rate from 4.63 percent to 6 percent. You can see how that compares to other states’ corporate income tax rates here. The average corporate income taxpayer would owe an additional $14,139, according to state fiscal analysts.

Would Amendment 73 raise my property taxes?

This is a complicated question. Amendment 73 does not raise property tax rates anywhere in the state. But if it passes, residential property owners will pay more in 2019 than they otherwise would have, while owners of non-residential property will pay less.

Amendment 73 fixes the assessment rate at 7 percent for residential and 24 percent for non-residential property. That’s lower than it is now, but other constitutional provisions would have pushed the residential rate even lower in 2019.

Exactly how much more or less you pay will depend on your property value, real estate trends in your community, and local tax rates.

This represents a partial fix to a complicated fiscal problem that has bedeviled Colorado lawmakers and the administrators of rural taxing entities — school districts, fire protection districts, and others — for years.

In Colorado, your property is assessed at close to market value, but your local tax rate only applies to a portion of that value. That’s the assessment rate. Another constitutional provision known as the Gallagher Amendment ensures that non-residential property owners always pay a larger share of property taxes than homeowners. Since 1982, when the Gallagher Amendment was approved by voters, property values along Colorado’s developed Front Range have skyrocketed, putting the assessment ratios between residential and other property seriously out of whack. Those ratios apply statewide, and many rural communities have seen their already sparse tax base hollowed out.

In the case of schools, that’s meant the state government has had to backfill more and more money that used to be generated by local taxes. Amendment 73 includes a provision to hold the assessment rates steady just for schools for two reasons. One is that it provides property tax relief to ranchers and farmers, which the measure’s backers hope bolsters support in parts of the state that are traditionally more hostile to tax increases. The other is that it ensures the new tax revenue generated by the amendment doesn’t just backfill an ever-deepening hole in rural districts.

Residential assessment rates will continue to drop for other taxing entities, creating an even more complex system, unless the state succeeds in a more comprehensive Gallagher fix.

Don’t schools get a lot of marijuana money already?

The bulk of marijuana tax revenue for education goes to a program that helps schools pay for buildings and construction repairs. Districts apply and compete for grant money from the program, and in most cases have to put up some portion of the project’s cost.

Starting this year, 12.59 percent of marijuana tax revenue is also set aside for the regular education budget. That’s about $20 million a year at current rates. Marijuana money is also set aside for various grant programs including one that schools can use to help pay for health professionals such as counselors or nurses. As the state collects more marijuana revenue, the amounts set aside for the grant programs has increased.

However, the marijuana money available to schools represents a tiny fraction of total education spending, and most of it can’t be spent on basic needs like teacher salaries or classroom materials.

Correction: This article has been updated to reflect the correct increase in special education funding proposed by Amendment 73. It’s 68 percent, not 6.8 percent.