Colorado teachers are marching at the Capitol this week for more school funding and better pay. Advocates for more education funding will point to the $7 billion that the state has withheld from schools since the Great Recession, while fiscal conservatives point to the billions the state has spent on schools in those same years.

Here’s what you need to know to follow the money debate behind these teacher days of action.

What does it mean when people say Colorado schools are underfunded?

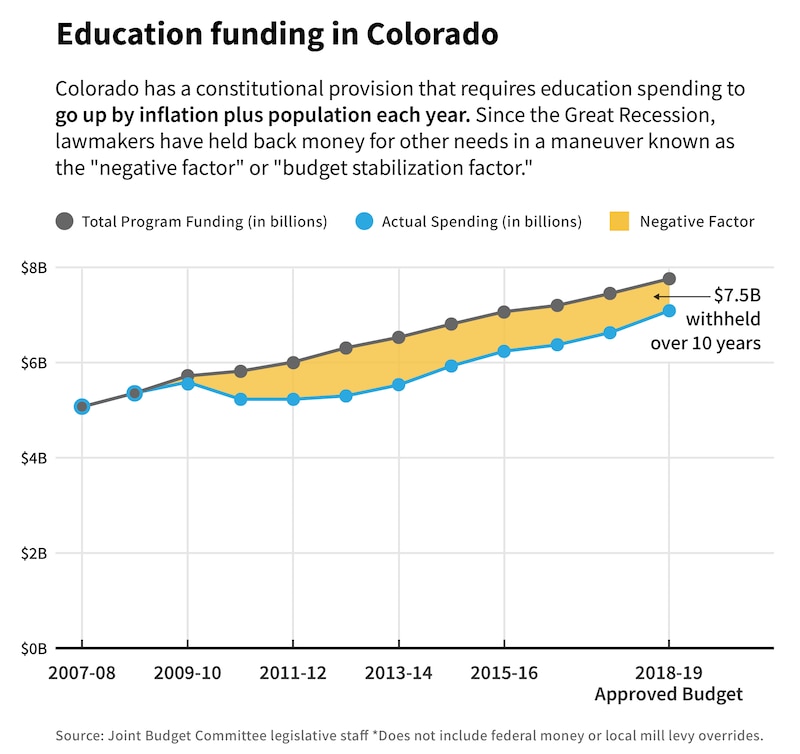

Back in 2000, Colorado voters approved a constitutional amendment that said the state had to increase K-12 education funding every year based on inflation and population. It was meant to reverse years of budget cuts in the 1990s.

When the Great Recession hit and revenues declined, state budget writers didn’t think they could meet that obligation and pay for other functions of state government, so they started holding money back. This reduction is known as the budget stabilization factor or the negative factor.

The negative factor ballooned to more than a billion dollars in the early aughts as the lagging effects of the recession hit government revenue.

State spending on K-12 education actually declined in some years, and many school districts froze pay and cut programs. More recently, lawmakers have reduced the negative factor and increased education spending, but the state continues to hold money back.

So that’s one thing people mean when they say Colorado schools are underfunded.

Republicans dispute this characterization. The Colorado Supreme Court, in a split decision in 2015, ruled that the state’s school funding and use of the negative factor is constitutional. Schools have other sources of revenue, including federal dollars and local property tax revenue.

The National Education Association’s 2018 state rankings puts Colorado 28th in per-pupil funding, when federal, state, and local dollars are included.

There are other considerations. Analyses that look at equity – how fairly Colorado distributes money among students and districts – give the state low marks. There’s major variation in per-student spending around the state. Colorado also spends much less money on education than most states with similar levels of wealth and economic activity.

We asked Colorado teachers what this looks like in their paychecks and in their classrooms, and they had a lot to say.

At the same time, the state is paying a larger share of K-12 costs than ever because tax provisions in the constitution have reduced local property taxes in many parts of the state.

What about local property taxes?

After state officials calculate the amount of money each school district should get, they collect that money first from the local property taxes. If that doesn’t meet the amount set by the formula, the state fills in the rest.

School districts don’t actually benefit much from increases in property values. If a school district collects more money because homes are worth more, the state holds back a corresponding amount.

This arrangement would seem to benefit the state at the expense of local districts, but in many rural communities, two conflicting provisions in the state constitution have had the effect of reducing assessed value. Because the state fills in the lost revenue, the state’s share of education spending is going up.

There are two ways local school districts can raise additional local money, but both require voter approval. Some communities, including Denver and Boulder, have passed significant tax increases to give their schools more money. Other communities in the state have never been successful in asking their voters for more local funding. Greeley’s District 6 had never passed a mill levy override until this November. District 27J in Brighton made the decision to go to a four-day week after voters turned them down for a 16th time.

If you want to learn more about local revenue and the variations it creates among districts, dig in here.

How much do Colorado teachers make?

According to the Colorado Department of Education, the average teacher salary for 2017-18 is $52,728.

However, there’s considerable variation across the state and even within districts.

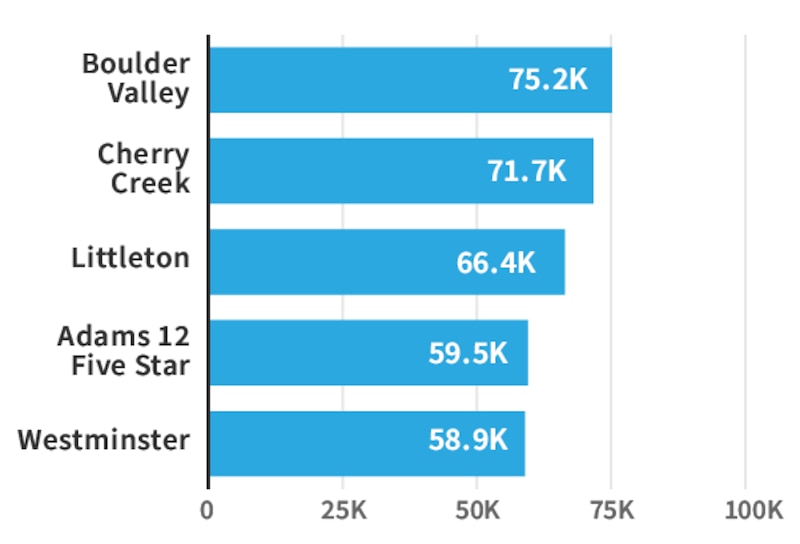

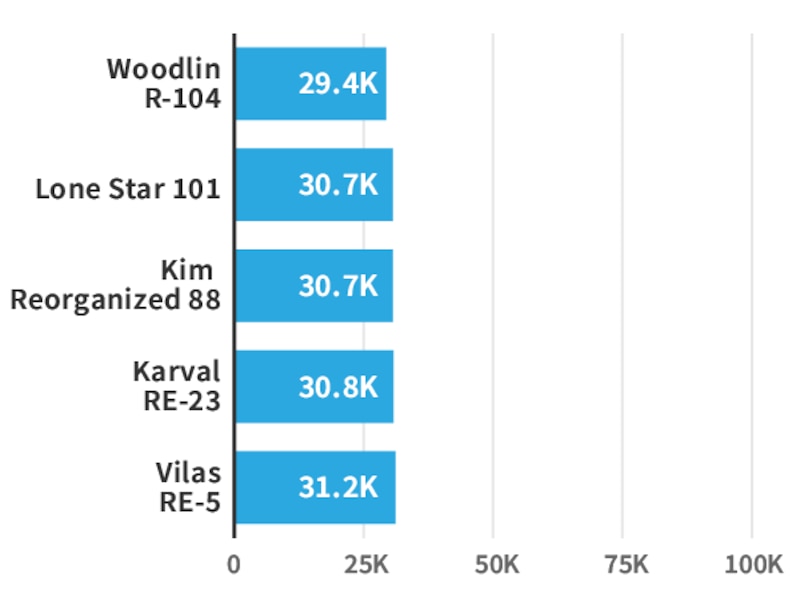

Teachers in the Cherry Creek and Boulder Valley districts have average salaries above $70,000. Many small rural districts have average salaries close to $30,000, an amount that’s hard to live on anywhere.

Colorado districts with the highest average teacher salaries

Colorado districts with the lowest average teacher salaries

The highest paid teacher in Aurora makes $102,115, and the highest paid teacher in Denver Public Schools makes $115,900. Those teachers would be veteran employees with decades in the classroom. Starting salaries in those districts are $39,757 and $41,689 respectively.

Starting salaries for new teachers and average salaries in 2017-18:

Teachers’ ability to get raises also varies considerably. Districts have salary schedules that provide for raises after a certain number of years of service or for getting more education, but in some districts, the range is narrow, with veteran teachers stuck close to $50,000.

Some districts, like Denver, also have performance incentives or offer additional money for working in schools where students have high needs. When those factors are included, Denver Public Schools places the average salary of its teachers at $57,753, while the Colorado Department of Education only reports base bay.

Many teachers experienced pay freezes during the Great Recession but are starting to get raises again. However, when adjusted for inflation, teacher’s salaries have declined in many districts.

A look at teacher salary over time:

How does that compare to other states?

A previous ranking that placed Colorado 46th in the nation for teacher pay turned out to be based on bad information. The most recent ranking from the National Education Association put Colorado at No. 31. Teacher pay is going up in Colorado after years of pay freezes as education funding slowly increases or as voters approve new local taxes.

Colorado teacher salaries are still well below the national average of $60,483.

And a recent report ranked Colorado dead last for the competitiveness of its teacher salaries. The report compared how much teachers earn compared to other people who also had college degrees. The study adjusted for number of hours worked.

That is, teachers in Colorado take the biggest hit for choosing to go into education as opposed to some other profession.

Did TABOR cause this situation?

Colorado’s Taxpayer’s Bill of Rights requires voters to approve any new taxes and puts a cap on how much revenue government can collect. This means that the state can’t necessarily keep all the extra revenue generated by existing taxes when the economy is doing well. Instead, the state has to issue refunds to taxpayers when revenues exceed the cap. In the past, TABOR also exerted a “ratchet effect” on state government. When revenues declined due to the economy, that reset the cap at a lower level. That provision is no longer in place.

So yes, TABOR helped set the stage. After several years of refunds in the boom times of the late 1990s, lawmakers passed permanent tax cuts. Those remain in effect. Voters have rejected most statewide tax increases, including two for education. TABOR imposed budget constraints that wouldn’t exist otherwise and made it harder for lawmakers to find new revenue. It’s also one of the constitutional provisions driving down property taxes in rural areas.

Many Democrats support a change to TABOR that would allow state government to keep all revenue from existing taxes in order to take advantage of boom times. Gov. John Hickenlooper told Colorado Public Radio that Colorado could put more money toward education without raising taxes if voters would agree to this change.

It’s not quite that simple. Hickenlooper’s proposal wouldn’t have any practical effect this year because Colorado’s tax revenues are below the TABOR-imposed cap. State government has the same amount of money to work with as it would if voters agreed to remove the cap entirely. The budget for 2018-19 still holds back $672 million from schools. That’s next year’s negative factor. Even when the state has more money, education still has to compete with a host of other needs, including transportation.

If the economy continues to do well, we might hit the cap again, and the state would have to issue refunds. One budget forecast says it could happen as soon as next year. And in that case, TABOR would contribute to education getting squeezed again.

Republicans argue that low taxes and restrictions on the growth of government have contributed to Colorado’s strong economy and that TABOR reform might kill the goose that laid the golden egg.

What does PERA have to do with all this?

Colorado’s public employee retirement system, in which teachers participate, has an unfunded liability of somewhere between $32 billion and $50 billion. As lawmakers try to address this, various proposals have called on both employees and employers to pay more.

Retirement benefits, like health insurance, make up a growing share of school districts’ personnel budgets, so if they have to pay more into PERA, that’s less money for other education needs, including teacher pay.

And teachers who feel like their paychecks are already too small also don’t want to pay more.

Proposed solutions also call for reducing cost-of-living increases for retirees, raising the retirement age, and putting more of taxpayers’ dollars into the system.

Democrats and Republicans don’t agree on the right balance, and whatever they decide will have implications for district budgets and teacher paychecks.

Teachers don’t get Social Security benefits, and many of them say that solid retirement benefits are an important part of compensation. They fear that a less generous package will make it even harder to hire and keep teachers.

What about the marijuana tax money?

The bulk of marijuana tax revenue for education goes to a program that helps schools pay for buildings and construction repairs. Districts apply and compete for grant money from the program, and in most cases have to put up some portion of the project’s cost. This money can’t be used for things like teacher salaries or books.

This year there’s bipartisan legislation to dramatically increase the amount of marijuana money that goes to fund this capital construction. Currently, only the first $40 million in marijuana tax revenue goes to the program. This change would set aside the first 90 percent of marijuana tax revenue for the construction grant program, up to $100 million.

Starting this year, 12.59 percent of marijuana tax revenue is also set aside for the regular education budget. That’s about $20 million a year at current rates.

Other marijuana money is set aside for various grant programs including one that schools can get to help pay for health professionals such as counselors or nurses. As the state collects more marijuana revenue, the amounts set aside for the grant programs has increased.

This post has been updated to correct information about how Colorado ranks in teacher pay, to include a section on TABOR, and to include average pay for Denver Public Schools teachers with incentives included.