Eight Indiana school districts will ask voters to approve property tax measures next month.

That includes two Indianapolis districts: Perry Township, which is seeking to renew a $154 million referendum, and Franklin Township, which is requesting $95 million to renovate its high school.

This will be the second election that school districts put referendums on the ballot using new state-mandated language that emphasizes the percentage by which school property taxes will increase — a change that education officials have criticized as misleading.

Despite this, some hope that the state’s low unemployment rate and growing home values will convince voters to open their pocketbooks.

“Now’s the time to do this,” said Fred McWhorter, chief operating officer at Franklin Township schools.

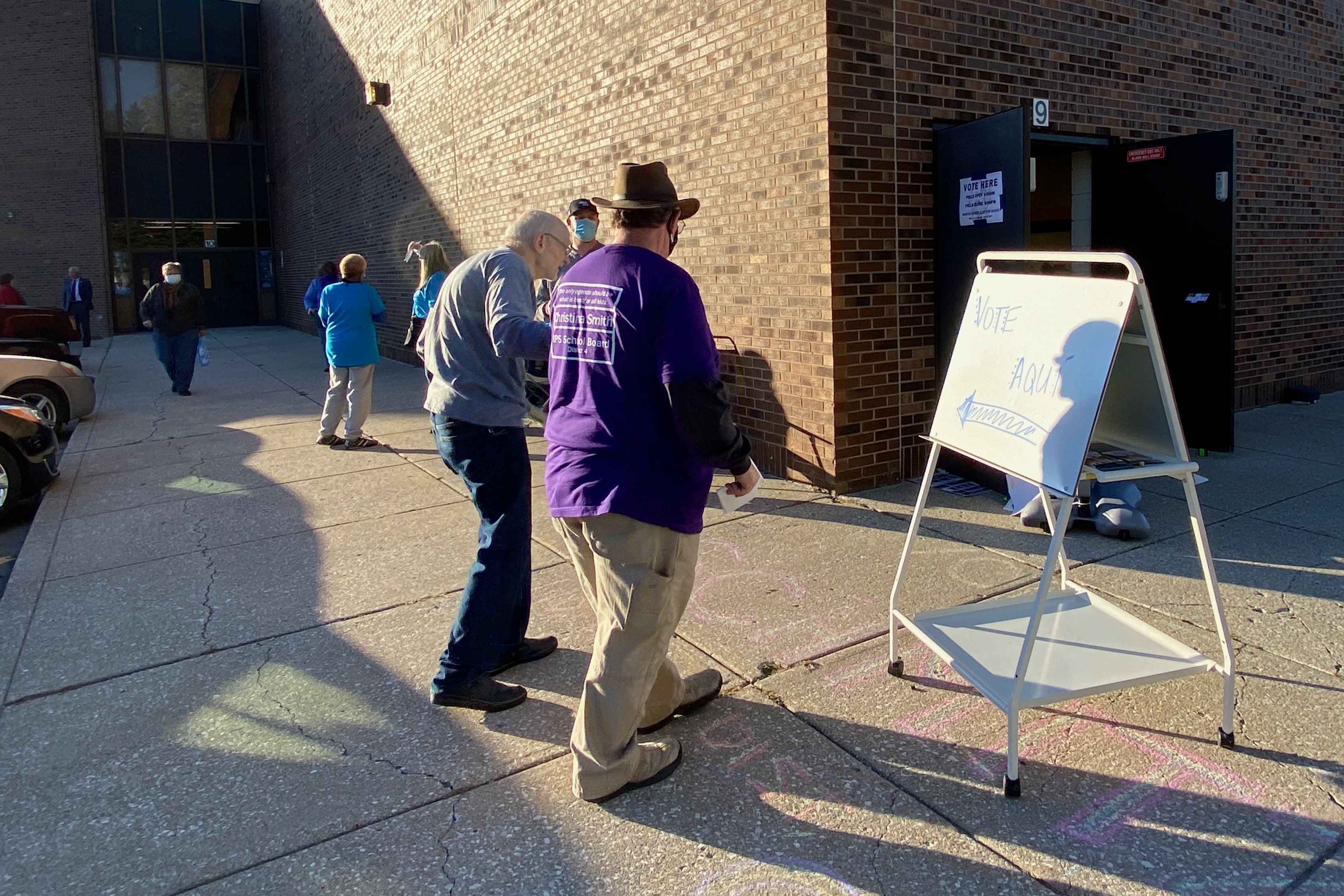

Early voting is underway ahead of the May 3 elections. All the referendums need a simple majority to pass.

Referendums after COVID

The number of referendums on the ballot has rebounded slightly after the COVID economic downturn, during which schools and voters were reluctant to increase taxes.

Indiana saw more referendums than ever in the spring of 2020, which were written before pandemic-related upheaval, said Larry DeBoer, a Purdue University professor emeritus who studies Indiana tax issues. In three elections during the pandemic, just seven referendums were proposed, and only four passed, he said.

Now, schools face an uncertain economy, DeBoer said, and ballot language that might cause sticker shock.

The tax rate change that school districts must post could lead voters to believe that their total tax bill would increase by the stated amount, DeBoer said, when it actually only the affects the portion of the bill that goes to schools.

Voters would have to know how much of their total tax bill goes to schools, then calculate the percentage change — perhaps in the voting booth, DeBoer said.

In Franklin Township, the ballot language highlights a 24.4% increase in property taxes earmarked for schools. But the average homeowner’s overall tax bill would increase just 10%, according to the district’s referendum calculator.

Referendum language is typically most important to voters who haven’t researched the issue beforehand, he said. Some voters may be put off by the length of the state-mandated language and choose to skip the question entirely.

“This is an experiment,” DeBoer said. “I’m all for informed voters. But what’s the best way to do that?”

Generally, May referendums pass at a higher rate than do November referendums, he said, and districts that previously have tried to pass a tax hike have better luck than those trying for the first time, DeBoer said.

In Indiana, unlike in some neighboring states, operational referendums have passed at a higher rate than have construction referendums, he said. The former can finance a district’s operating costs for eight years, while the latter are earmarked for a specific building project.

Marion County referendums on the ballot

Perry Township is seeking to renew its 2015 operating referendum to support 20% of its teaching force, as well as transportation for all students, and a science, technology and math program.

If passed, the referendum tax rate of 0.4212 per $100 of assessed value would remain the same. If the renewal fails, Perry property taxes would decrease.

A renewed referendum would last eight more years and generate over $19 million in revenue each year, Superintendent Pat Mapes said. The referendum would continue to pay for 193 teachers, 20 assistant principals, 17 tech positions, and 14 instructional assistants.

It would allow the district to continue to finance a popular STEM program for first through 12th grade students, Mapes said.

Should voters reject the referendum, Perry would need to cut art, music, STEM courses, transportation, and teachers. Class sizes would rise. More students would walk further to school.

“When you’re doing a renewal, you’ve already decided to support your schools,” Mapes said. “You know that strong schools equal a strong community.”

Six other school districts are asking local voters for operational support, including Edinburgh, Griffith, Lebanon, Mt. Vernon, and Valparaiso.

Lebanon is also asking for a construction referendum, along with Vigo and Franklin Township schools.

Franklin Township is seeking a construction referendum primarily to fund an expansion and repairs to its 50-year-old high school building, as well as make some smaller improvements to its elementary schools. The district’s last referendum — an operational question in 2011 — failed, which district officials attributed to the economic recession.

The district is the only one in Marion County to not have passed an operational or construction referendum before.

McWhorter, the chief operating officer, said enrollment has grown by 1,800 students in five years, and likely will increase more with new construction in the area.

The high school needs new plumbing and HVAC systems, and a new roof which alone is expected to cost around $7 million, he said.

Franklin Township has used about $3.8 million of its federal emergency funding and $2 million in other funds to upgrade ventilation in elementary schools, McWhorter said. The district opted not to use federal relief funds for the high school because the extensive repairs would take two years, beyond the time limit for using the relief funds. The district received about $11 million total in federal ESSER dollars.

The referendum would increase taxes by 0.2099 per $100 of assessed value and generate about $95 million. For a home with the Marion County median value of $185,700, the annual increase would be $185.67, according to the district’s calculator.

If the referendum fails, McWhorter said the district would not be able to repair and maintain facilities, which would continue to deteriorate.

“The growth is not going away, the aging facilities are not going away,” McWhorter said. “What we can promise is it’s not going to be any cheaper later.”

Aleksandra Appleton covers Indiana education policy and writes about K-12 schools across the state. Contact her at aappleton@chalkbeat.org.