Indiana General Assembly

The ILEA’s recommendations are heading to lawmakers, who see the potential to replicate many of them throughout the state but could be skeptical of giving mayors more power.

The 8-1 vote on the recommendations came amid increasing public pressure to retain the power of the elected school board over district buildings and transportation.

The Indianapolis Local Education Alliance could make specific recommendations for key issues like funding, transportation, and the growth of public schools — or it could let state lawmakers fill in the blanks.

The Indianapolis Local Education Alliance is meeting Dec. 3 to start narrowing down recommendations for changing who runs schools.

Voters in six school districts cast ballots on Tuesday to decide whether referendums should pass. Only one district’s referendum failed.

The law aims to make sure students pass the IREAD before going to fourth grade. It’s part of a slew of policies aimed at improving literacy in the state.

State education leaders unveiled a second draft of an accountability system for schools. And it focuses on more than just test scores.

The new group, created by state lawmakers, will issue recommendations later this year on how charter schools and IPS can share transportation and facility resources.

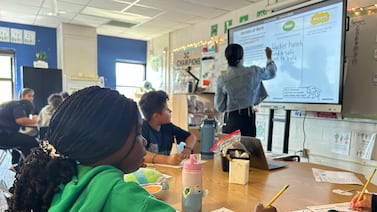

Third graders who did not pass a state literacy exam are using summer school as one final chance to pass and proceed to fourth grade under a tougher grade retention law.

Indiana lawmakers did not pass legislation on mental health and school counselors this year. But schools are proceeding with the programs and looking for outside funding sources.

The four June meetings will focus on how the district should engage with the new Indianapolis Local Education Alliance

The Indianapolis Local Education Alliance includes former mayor Bart Peterson, City-County Councilor Maggie Lewis, and IPS teacher Tina Ahlgren.

Superintendent Aleesia Johnson said that while she’s deeply concerned about the changes brought by a new property tax law, the district will strive to engage the community.

The Indianapolis Local Education Alliance must submit a plan for sharing transportation and facilities between IPS and charter schools by the end of the year.

A proposed property tax relief bill would also require school districts to share operating property tax revenue with charter schools, amounting to a roughly $744 million cut for districts statewide over the next three years.

The Senate’s budget proposal comes as lawmakers advance property tax reforms that could cut funding for many school districts.

The initial makeup of the Indianapolis local education alliance sparked concern from Indianapolis Public Schools. Now, the district said it’s encouraged by the proposed group’s “balanced representation.”

The accounts pay for high schoolers to learn about everything from aviation to HVAC directly from local employers. But it’s not easy to get basic information about the program.

As a bill requiring IPS to share property tax revenue advances, members of the public debated the extent to which different types of schools should receive funding.

House lawmakers have passed their proposed budget, which includes $9.6 billion in tuition support dollars that fund public schools and the private school voucher program.