When I got my first paycheck for working on a political campaign and nearly a third was taken out for taxes, I was startled because I was only making minimum wage. I shrugged it off assuming this was why grown-ups always are always complaining about taxes.

As I recounted this as a coming-of-age story to family friends, someone explained to me that I could likely get some of that money back if I filed a tax return the following April. While the finance terms flew over my head, I perked up immediately at talk of a tax refund. I hadn’t known this was possible, and I’m not alone.

Many high school students are about to face one of the biggest financial decisions of their lives: how to pay for college. Yet a lot of us are unprepared to make this decision and many others that will follow — from paying rent to using credit cards to saving for the proverbial rainy day. What we don’t know about money management can follow us for decades to come.

I go to Stuyvesant High School, where students can take over 30 AP classes and choose from more than 50 electives. But until recently, there was no personal finance class. Students were graduating well prepared for college, but often clueless about managing their money.

In 2021, I wrote in my high school paper, The Stuyvesant Spectator, about the need for financial literacy education; my piece pushed Stuyvesant to create a personal finance elective the following school year. I was delighted by the school administration’s responsiveness to the article but soon realized that just offering the class was not enough. In a grade of over 800 students, only 8% of seniors could take the course.

Unable to enroll due to high demand, I sat in on the class a couple of times. I watched as seniors reviewed their college acceptances and financial aid packages, and were shown how to create a budget with the real numbers at hand. During another lesson, they learned about marketing tactics that companies use to lure customers; students created their own imaginary companies using those strategies to understand how to avoid falling for misleading marketing claims.

Financial literacy is not a topic only some students should get to understand. It’s like a health class: a field of critical knowledge every high schooler needs (yes, even if that means yet another graduation requirement). Recognizing this, The Stuyvesant Spectator’s editorial board published a special issue titled “The Stocktator” to promote the class and its expansion. We talked to teachers, students, and alumni to figure out what students wanted and needed from a financial literacy class.

A bill that would require schools to offer and students to complete a financial literacy course is in committee in the New York State Senate.

We found that 89% of students surveyed didn’t know how to take out a college loan, and 92% of students wanted more financial education. Alumni shared stories of misusing credit, filling out federal financial aid paperwork without parental help, going into immense debt, and still not understanding how to do their taxes.

In response to the student demand and advocacy through journalism, our administration expanded the personal finance course from one to two sections, but without state mandates, it is difficult to offer it to everyone. More than a dozen states mandate personal finance education for high schoolers, but New York — the nation’s financial capital — isn’t one of them.

New York State currently requires economics classes (necessary for graduation) to touch on personal finance, but in reality, at least a semester is needed to introduce topics such as budgeting, banking basics, buying vs. renting, insurance, identity theft, and credit scores.

There are many high schools that won’t have the resources to start a personal finance class without a state mandate. A bill that would require schools to offer and students to complete a financial literacy course is in committee in the New York State Senate.

I hope to be lucky enough to nab a spot in Stuyvesant’s personal finance class next semester because I still don’t know how to take out a college loan or how to safeguard against identity theft. I’m still fuzzy on the difference between a checking and savings account, and I don’t know what my credit score is. While I got my tax refund, the process was so complicated that I let my dad figure it out. But I’m almost an adult, and I don’t want to start my independent life limited by my lack of financial literacy.

High schoolers focus a lot on scores when it comes to the SAT, ACT, and their GPA. But few of us know enough about the score that will follow us through adulthood: our credit score. After high school, some of us will never again solve a calculus problem. Our test scores and GPAs will fade into inconsequential measures of past achievement. But every single one of us will have to manage our finances. That is what we need to learn.

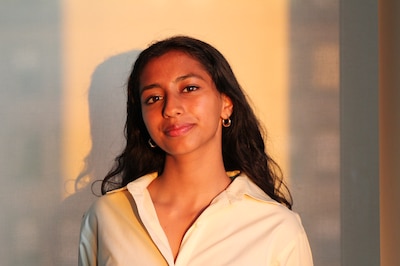

Anisha Singhal is a senior at Stuyvesant High School and the opinions editor of the school newspaper, The Stuyvesant Spectator. She is an advocate for financial literacy and a soccer player. You can often find her Citi Biking around New York City.