A new report from the Department of Higher Education casts fresh light on a never-ending worry for parents and policymakers – rising college costs.

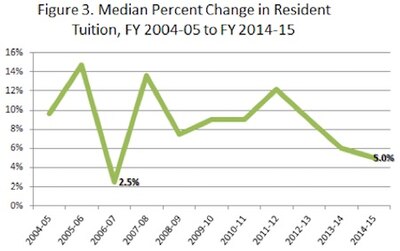

The 2014-15 Tuition and Fees Report, presented to the Colorado Commission on Higher Education Friday, found that the median increase in resident tuition for the year was 5 percent. That was the lowest since the 2.5 percent recorded in 2006-07, before the 2008 recession slashed state revenues and forced cuts in higher education spending, which led to substantial tuition increases.

The combined average burden of resident tuition and student fees rose 4.7 percent in 2014-15 over the 2013-14 school year. The average tuition-and-fees increase was 5.7 percent at four-year schools – about $462 – and 3.8 percent at community colleges, about $150 per student.

Over the last decade, tuition and fees have increased by an average of 8-12 percent a year at four-year state colleges and universities. (As the chart shows, there were wide swings in percentage increases year to year.) So while the 2014-15 figures may look better to students and parents, lower rates of tuition growth may not last.

First, the 2014 legislature capped annual tuition increases at no more than 6 percent this year and in 2015-16. That cap was accompanied by a $100 million increase in higher education support for this year. Gov. John Hickenlooper has proposed a $60 million increase for the next school year.

But the flow of additional state money may soon dry up, and the tuition cap is set to expire. (A Senate committee recently killed a bill that would have extended the 6 percent ceiling indefinitely. Lawmakers were persuaded by college leaders’ concerns that they may have to rely more heavily on tuition the next time state support is trimmed.)

State budget director Henry Sobanet briefed the commission on state budget prospects during Friday’s meeting and warned that in the 2016-17 budget, rising demands for K-12 spending, transportation, and refunds required by the Taxpayer’s Bill of Rights could mean “everything else will have to drop by $148 million.”

Asked by CCHE chair Richard Kaufman about the potential impact on colleges and universities, Sobanet said, “Under some circumstances it could end up being that there are cuts to higher education.”

Lt. Gov. Joe Garcia, speaking earlier in the meeting, also noted “We know that in the next couple of years we may again be in a situation where we’re cutting.”

Inside the report

Dating back to 2010-11, increases in base tuition have varied widely by college. At the high end, five-year increases were 74.8 percent at Adams State University, 64 percent at Fort Lewis College, 61.8 percent at Western State Colorado University and 60.1 percent at Metropolitan State University. The lowest percentage increase was 23 percent at CU-Colorado Springs. The community college system had a 29.8 percent increase.

Looking at fees alone, over the last five years increases have ranged from a low of 5.8 percent at Colorado Mesa University to 72.5 percent at Western. (Fees have risen sharply at Western and a few other institutions because fees were used to fund campus construction projects when state support for projects dropped.)

According to the College Board, average four-year tuition and fees increased 2.9 percent nationally in 2014-15. Colorado’s average tuition and fees were slight above the national average of $9,139 this year. But Colorado’s per-student state support – $3,494 – was the second-lowest in nation and well below the national average of $7,072.

The department also reports annually on student financial aid and debt in a separate study. The 2013-14 version of that report found that 70 percent of students graduated with debt from four-year institutions. The average debt was $26,057 for a bachelor’s degree. Of students who earned an associate degree, 65 percent used loans, and the average debt upon graduation was $14,344.