Since public schools were founded, arguments have raged over how to pay for them.

In Colorado, it’s one of the perennial debates that gets the best of lawmakers, lobbyists, school leaders and advocates every year. Further frustrating things, lawmakers can only do so much because constitutional amendments lock in much of the state’s budget.

It’s no chump change: More than $6 billion in Colorado tax money goes toward schools.

As Colorado lawmakers get to work on crafting the state budget, here are some questions and answers about how the school funding system works in the Centennial state.

How the heck does Colorado fund its schools?

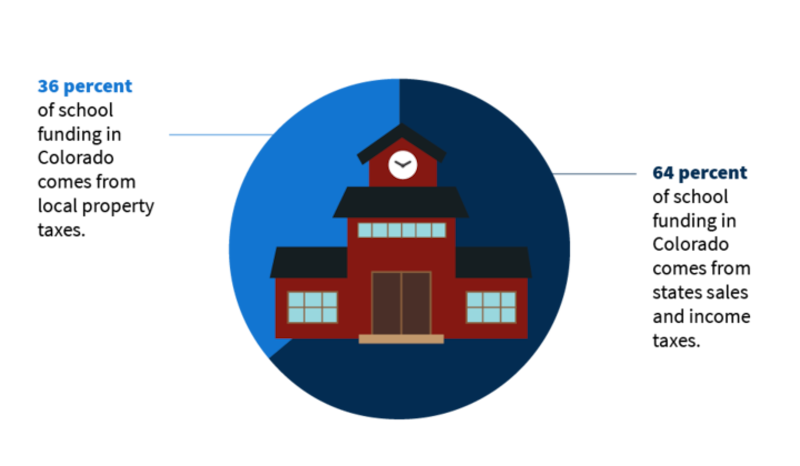

Colorado funds its schools from two major sources of revenue.

The first pool of revenue is called the “local share.” This money comes from local property taxes on homes and businesses. The second pool is the “state share.” This revenue comes from income and sales taxes.

Historically, schools received about an equal share of their funding from the local and state shares. However, for a variety of reasons, the state has had to dramatically increase its contribution to schools during the last two decades.

Many schools, especially those that serve large populations of at-risk students, also receive federal money.

What about marijuana taxes? Aren’t schools seeing a windfall from recreational sales?

No.

The first $40 million of tax revenue collected from marijuana excise taxes — a wholesale tax — goes to a special fund to help school construction. That doesn’t go very far.

However, given a tightening state budget, Gov. John Hickenlooper has suggested increasing taxes on pot to help fund school operations. Lawmakers haven’t been keen on that idea.

Does every school district get the same amount from the state?

No. Lawmakers use a funding formula to determine how much money each school district gets. The formula, which was written in 1994, takes in a variety of factors including student enrollment, the district’s cost of living and how many at-risk students the district serves.

The large suburban district in Douglas County received $7,050 per student this year. Thirty-four percent came from local taxes, while the state picked up 66 percent of the cost.

The smaller Mapleton school district in Adams County, which serves a large Latino population, got $7,303 per student. But only 24 percent came from local property taxes, while the state kicked in 76 percent of the cost.

The tiny Aguilar school district in southeastern Colorado received $13,600 per student. The locals pitched in 25 percent and the state took care of the rest.

What determines the size of the local share?

School boards have no say in how much local property taxes contribute to their funding. That’s left to a complicated constellation of constitutional amendments and state law.

First there’s the Gallagher Amendment. Adopted in 1982, the amendment requires the state to maintain a 45 percent to 55 percent ratio ratio between the revenue collected from personal property and business property. When home values go up, the state is required to drop the percent on which property can be taxed. In 1980, the rate was 21 percent. In 2013, it was 7.98 percent. That means a smaller proportion of a home’s actual value can be taxed by school districts.

The second constitutional amendment in play is the Taxpayer’s Bill of Rights, or TABOR. Approved by voters in 1992, TABOR puts a cap on how much revenue the state and local governments can collect from taxpayers. It also requires governing bodies to seek permission from voters before increasing taxes.

While all but four school districts have received voter approval to keep excess tax revenue, lawmakers have put two key restrictions on school districts.

First, until 2005 school district property taxes could only increase by inflation and enrollment growth. When that revenue exceeds the limit, school districts had to reduce their tax rates. And because of TABOR, once the tax rate is lowered by statute, it can’t be raised without voter approval.

(If you want to sound super-smart at your next PTA or school board meeting, this was known as the “ratchet effect.” In 2005, voters approved Referendum C, which ended this effect.)

Lawmakers put an additional check on school districts in 2007 when they put a statewide cap on school districts’ tax rates.

What determines how much the state is supposed to kick in?

While there are two amendments that put restrictions on how the state can generate revenue to fund its schools, there is another Constitutional amendment that spells out how the state is supposed to spend that money.

Amendment 23, approved by voters in 2000, did a few things, but two points are still relevant today.

First, Amendment 23 requires the state to increase funding based on population growth and inflation. Second, it created the State Education Fund, an account lawmakers are relying on more heavily to pay for schools. It is financed by one-third of 1 percent of federal taxable income that is exempt from TABOR limits.

Wait, if lawmakers are required to increase funding each year, why does the state have an education funding shortfall?

During the Great Recession, when lawmakers were forced to slash hundreds of millions from the state budget, they argued that Amendment 23 only covers “base funding,” or the average every school district receives per pupil.

The amendment, they argued, doesn’t govern the additional money districts receive to compensate for size, at-risk students and other factors.

So in 2010, lawmakers created “the negative factor,” a new tool they could use to make across- the-board cuts to school funding after all other factors (size, at-risk students, cost-of-living) are taken into consideration.

As part of a compromise, lawmakers are required to report how much money they’re not giving to schools based on that legislative tool.

A lawsuit challenged the negative factor. But the state Supreme Court ruled in favor of lawmakers.

So while a large portion of funding must increase every year, lawmakers have places to cut education in a pinch. The current shortfall is at $828 million, down from a $1.01 billion in 2013.

Didn’t a bunch of school districts just pass tax increases?

Yes, and according to some, that’s making the situation worse.

As the state’s finances have squeezed, some school districts have turned to local voters to ask for more local revenue. These tax increases, known as mill levy overrides, exist outside of the state’s school funding system. The more voters approve doesn’t lessen the state’s burden.

There are some school districts like Boulder, Denver and Cherry Creek that have generated millions of local revenue but are still getting their equal share from the state. Meanwhile, districts like Greeley, Pueblo and Sheridan have never been able to convince their voters to approve a tax increase. That means they have to get by with whatever the state gives them.

Update: This post has been updated to reflect that the “ratchet effect” no longer exists after voters approved Referendum C.