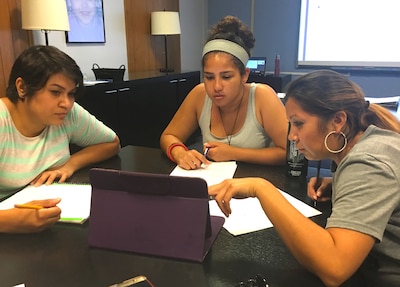

Scattered around a meeting room in groups of three or four, 13 women bent over laptop computers and smartphones, squinting at Colorado’s hundreds of child care regulations.

They were child care and preschool employees from all over Denver on a scavenger hunt of sorts, searching for answers to worksheet questions such as how quickly child care workers must be trained on child abuse reporting and which eight kinds of toys and equipment classrooms are required to have.

The exercise on a recent Tuesday night was part of a 120-hour course — the equivalent of two college classes — that leads to a nationally-recognized child care credential.

Leaders at Mile High Early Learning, which operates seven centers around Denver, decided last summer to launch the training program to help solve one of the organization’s — and the field’s — most intractable problems: A shortage of qualified teachers and assistant teachers.

“We were having difficulty finding staff so we thought, ‘How could we grow our own?’” said Pamela Harris, the organization’s president and CEO.

In a field known nationally for low pay and high turnover, Mile High’s staffing struggles are hardly unique. What’s more unusual is the organization’s decision to address the problem with a formal in-house training. It’s a move that illustrates the anxiety providers face in finding high-quality staff and the gaps that exist in the state’s early childhood worker pipeline.

Over the next three years, a new state early childhood workforce plan aims to fill some of those holes, in part through alternative pathways like the training offered by Mile High. But experts agree the task is formidable.

In Colorado, the dearth of well-trained child care and preschool teachers has worsened in recent years even as evidence mounts that quality caregivers play a critical role in setting kids up for long-term success.

Christi Chadwick, who heads the Transforming Colorado’s Early Childhood Workforce project at the nonprofit Early Milestones Colorado, said the state’s population growth, stagnant wages in the field and more demanding worker qualification have exacerbated the problem. It’s particularly acute for community child care providers, which can’t usually pay preschool teachers as much as school districts do.

“The compensation is a challenge,” Chadwick said. “If we’re going to ever professionalize the field, we have to think of how we have our teachers on par with those in elementary education.”

A winding road

Experts say many child care workers back into the profession — following a twisting path that may not include any formal training on how to work with little kids.

Some come in with only high school diplomas, some with associates degrees and some with bachelor’s degrees, though often in unrelated subjects.

Take Muna, a 24-year-old participant in the recent Mile High training. She holds a bachelor’s degree in international affairs from the University of Colorado Boulder and has held jobs working with adult refugees and teaching high school girls in Saudi Arabia.

Until eight months ago when she became a staff aide at Mile High’s center in the Lowry neighborhood, Muna had never worked with young children.

Staff aides are entry-level workers who make about $12 an hour. They allow Mile High to meet staff-child ratio requirements, but under state rules, can’t be left alone with children.

Muna, who asked that her last name not be used, is exactly the kind of person Harris wants to nudge up the career ladder with the new training program,

“We want to push them out of staff aide. We want them to be teacher assistants,” Harris said, noting that a pay bump comes with the promotion.

Mile High is among a variety of organizations that offer the training, which leads to a credential called the Child Development Associate. Mile High staff can take the course for free as long as they commit to stay for a year. Employees at other Denver area centers can participate for a fee. Harris said one of Mile High’s next steps will be to offer the training in Spanish.

For Muna, the course was mainly a way to learn the ropes of a profession she’s found both fulfilling and unfamiliar.

“I felt like I really didn’t know anything,” she said. “I didn’t want to be making mistakes or doing anything wrong.”

During the scavenger hunt activity, Muna and her two partners — both of whom work at centers outside the Mile High network — talked about the maze of rules that govern child care.

Muna recalled how jarring it was to learn that she had to don gloves first before tending to a crying youngster with a bloody nose.

Megan O’Connor, a former marketing officer and the mother of a teenage boy, laughed about the fact that there’s not only a specific technique for changing a baby’s diaper, but also for throwing the diaper away.

The changing pipeline

Starting in the 1980s, state law prohibited Colorado’s universities from offering bachelor’s degrees in early childhood education. When that changed a few years ago, it opened the way for a new crop of college graduates with specialized coursework focusing on young children.

But that spigot, while promising, is also very new.

A recent survey of about 5,000 early childhood workers across the state revealed that while just over half of lead teachers have a bachelor’s degree, only 25 percent have degrees in early childhood education or a closely related field. (The full results of the survey are due out in mid-August.)

Diane Price, president and CEO of Early Connections Learning Centers in Colorado Springs, was pleasantly surprised this summer to land three new teachers who’d recently graduated with bachelor’s degrees in early childhood. But with more than 40 percent of her staff turning over every year, recruitment is still a battle.

“I firmly believe that right now in early education you either grow your own or steal from someone else,” said Price, who was a member of the steering committee that helped developed the state’s new plan.

Early Connections doesn’t offer its own Child Development Associate training like Mile High does, but the course is available through local partners.

Both Harris and Price say the training is enjoying a resurgence at the moment. It provides a gentle way of introducing child care workers, who may find college intimidating or unaffordable, to the prospect of higher education.

“We don’t want this profession to be a dead end,” Price said. “We want them to see there is a pathway. You can become a teacher, you can be a lead teacher … You can be a director some day.”