Denver Public Schools is eliminating the kindergarten program it offers advanced students because of declining enrollment in the program and because it serves disproportionate numbers of white and higher-income students.

The end of the advanced kindergarten program at seven schools is part of the district’s ongoing efforts to address racial and socioeconomic segregation at schools and within programs. In recent years, district officials have made changes meant to include more students of color in programs for highly gifted students and International Baccalaureate tracks, and in June, the district launched a citywide committee charged with finding ways to better integrate district schools.

District officials said the elimination of advanced kindergarten not only ties in with their focus on equity among students but will also free up money to train kindergarten teachers districtwide on strategies for serving advanced learners.

The move left some parents confused.

“This all sounds so nuts,” one commenter said in a Facebook thread after DPS announced the end of advanced kindergarten on its website last week.

Rumors circulated that even though the district will no longer test 4-year-old students for advanced status in the fall before their kindergarten year, certain schools would continue to do so.

But that’s not true, said Rebecca McKinney, the district’s director of gifted and talented education, on Thursday.

Instead, she said, families with children entering kindergarten in 2018 will go through the district’s school choice process in the spring — this time with no advanced kindergarten option. Then, next fall, all kindergarten students will take the same routine assessments. For those who meet the criteria to be designated as advanced, their schools will decide how to best meet their needs.

In practice, that could mean separate classrooms if there are enough advanced kindergarteners in a given school, McKinney said. It could also mean that advanced students join first grade classes for certain subjects or that kindergarten teachers adjust lessons to match the students’ advanced skills.

“It allows more of our kids to be looked at as advanced learners,” McKinney said. “It’s not, ‘Did my parents get the application in on time?’ ”

Among the five large metro area districts, only DPS currently offers an advanced kindergarten option. It’s for students who enter school at the usual kindergarten age, but are academically advanced.

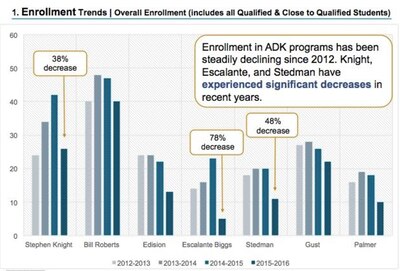

The seven Denver schools offering advanced kindergarten this year are Gust, Stedman, Palmer and Edison elementaries, Bill Roberts School, and two early childhood centers: Escalante-Biggs Academy and Stephen Knight Center for Early Education. After steady declines in advanced kindergarten enrollment since 2012, only 143 students are enrolled this year.

(An eighth school — Polaris at Ebert Elementary, a magnet program for the highly gifted — eliminated advanced kindergarten after last year because it gave kindergarteners an unfair advantage in gaining access to the school’s higher grades.)

Launched in 2004 at a time when the district was concerned about declining enrollment, the advanced kindergarten program eventually grew to enroll more than 200 students — most of them white and from middle- or upper-income families. In contrast, about two-thirds of students districtwide come from low-income families and three-quarters are students of color.

One of the reasons for the disparity was the admissions process for advanced kindergarten. It required parents to apply for testing almost a year before their children would enter kindergarten. There was also a fee to get children tested, although it was based on a sliding-scale system that provided discounts and even free testing.

“There is a lot of privilege wrapped up in the current model and knowing when the deadline comes,” said Keely Buchanan, co-founder of Preparing for Denver Kindergarten, a service that helps parents navigate Denver’s school choice system.

In theory, she said, she understands district officials’ instinct to eliminate the handful of dedicated programs for advanced kindergartners and make sure those students are served at all district schools.

As news of the change began swirling around last week, some parents feared that advanced kindergarten classrooms would continue in an under-the-radar way at a few of the district’s most sought-after and best-funded schools, creating even more inequity than there is now.

Kelly Dulong, the mother of an advanced kindergartener at Bill Roberts School, worried about that prospect. Yet, she said, she believes grouping students by skill levels can make it easier on teachers.

“I think there’s a real value in having a cohort that meets a certain threshold,” she said. “The reality is there’s 27 kids in the classroom and it’s really hard to differentiate.”