Greta Shackelford moved to Breckenridge 13 years ago on a whim. She was young and single at the time — a Virginia native enjoying life in a Colorado ski town.

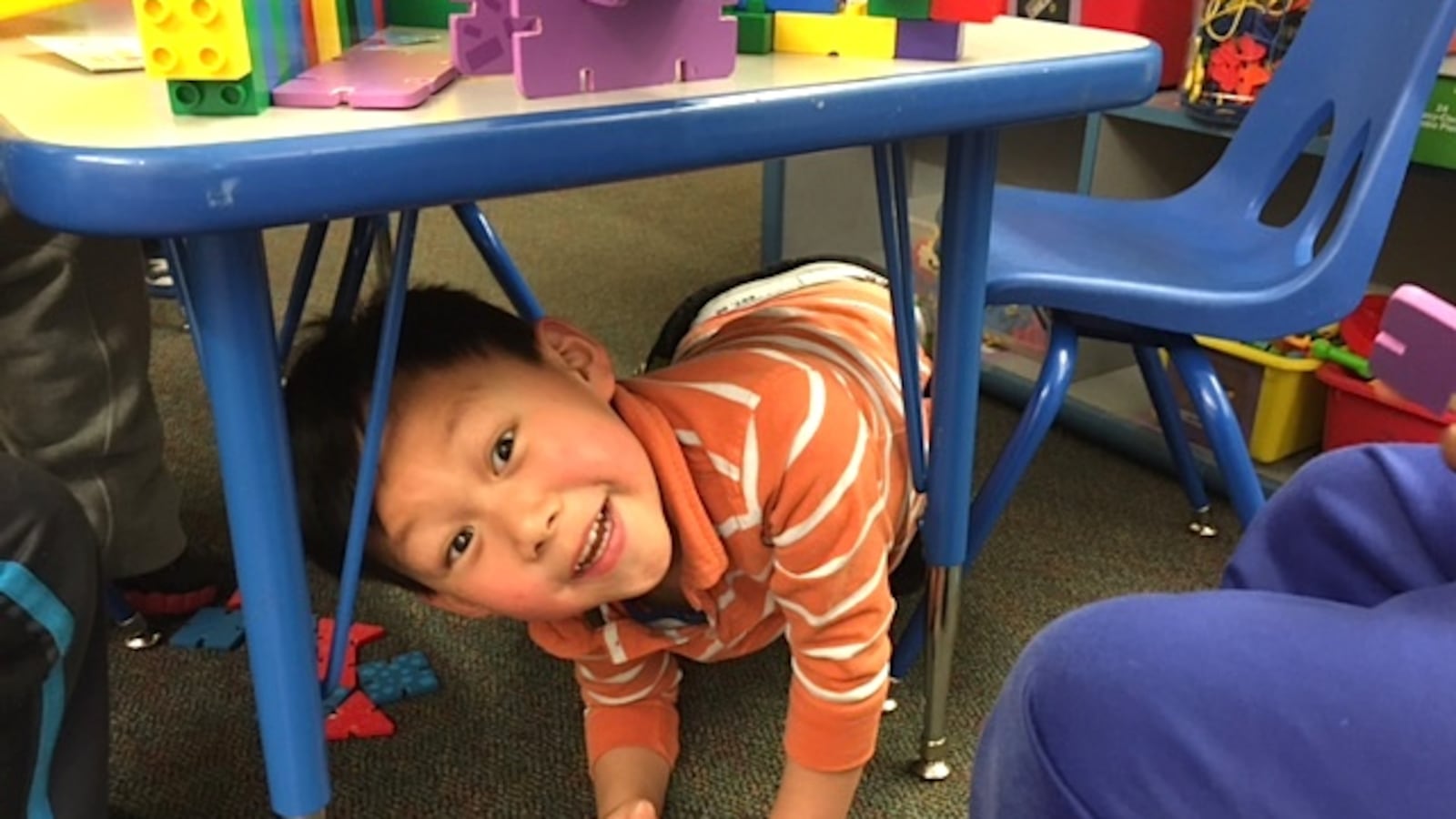

Today, Shackelford is married with two young children and heads a local child care center called Little Red Schoolhouse. She’s also one beneficiary of Breckenridge’s decision a decade ago to pump hundreds of thousands of dollars annually into the town’s child care industry.

Back in 2007, she got a substantial raise when town officials boosted salaries for local child care teachers by 30 percent and today, she and her husband, a general contractor, get help covering preschool costs for their 3-year-old son and 4-year-old daughter. In addition, because the town helped pay off some centers’ mortgages, there’s a financial cushion in case the boiler breaks or the roof leaks at Little Red Schoolhouse.

The effort in Breckenridge is among a growing number of initiatives across the state that use public money — usually gleaned from local property tax or sales tax — to improve child care and preschool options. Beyond helping prepare young children for school, these initiatives can be a vital cog in the local economy, keeping parents in the workforce and businesses adequately staffed.

And more could be coming soon. Leaders in San Miguel County, where Telluride is the county seat, are gearing up for a November ballot initiative that would help expand child care facilities and boost teacher pay. In Estes Park, advocates are just beginning a process to determine the town’s child care needs and explore funding options.

“It’s because some child care deserts are seemingly insurmountable and entrenched that local leaders in early childhood are looking at all possibilities,” said Liz Houston, executive director of the Early Childhood Council Leadership Alliance.

Experts say local efforts can be a heavy lift for community leaders charged with galvanizing support for tax hikes or other publicly funded proposals. But when successful, they provide much-needed stability to an industry plagued by low pay, high turnover, a shortage of slots and wide variations in quality.

Leaders in Breckenridge say child care is just as critical as plowing snow.

“Just like we need to plow our roads so people can get to our ski area, … this is just as important,” said Jennifer McAtamney, the town’s child care program administrator. “If we lose our workforce, it’s a huge problem.”

Some early childhood leaders hope these locally-funded projects can serve as a stepping stone to more ambitious statewide efforts in the future. (The state already runs programs that provide half-day preschool to at-risk children and child care subsidies for low-income families, but demand far outstrips supply.)

“Support for early childhood education is probably going to be built community by community by community until there is enough of a groundswell for it to be something that is statewide or nationwide,” said Jennifer Landrum, president and CEO of the Denver Preschool Program.

Like in Breckenridge, government funded early childhood initiatives have existed for years in Denver, Aspen, Boulder County and Summit County. A couple others — in Dolores and Elbert counties — have launched more recently, according to a list maintained by the business group Executives Partnering to Invest in Children, or EPIC.

One of the factors that unites communities that have taken on locally funded early childhood initiatives is a sense that things were at or near a crisis point. In Colorado’s resort towns, where many describe the cost of housing and other basics as astronomical, this is especially true.

Early childhood advocates in these communities can rattle off numbers that illustrate just how hard it is to find quality child care: waitlists that run into the hundreds, towns with few or no licensed slots for babies, centers that can’t find child care workers to staff their classrooms.

Shackelford, the director of Little Red Schoolhouse in Breckenridge, said the town’s effort, which includes another cash infusion to boost salaries in 2018, has reduced employee churn. Her own experience is a case in point.

Without the town’s financial help — with both child care and housing — “we would never have been able to afford to stay in Breckenridge,” she said. “It makes it, not cheap, but manageable.”

Gloria Higgins, president of EPIC, expects the number of municipalities that take on locally funded early childhood efforts to go up over the next decade.

By then, she said, “those communities in the most distress will probably have something and those are the mountain resort communities … They’re going to lead.”

But she also expects cities like Pueblo and some in the Denver suburbs to hop on board, too.

Higgins is an enthusiastic evangelist for such efforts. They fit well with Colorado’s local control ethos and can be tailored to each community’s needs. Still, she cautions those interested that it takes about four years of planning to get the job done.

“It’s a big deal to get the taxpayer to say yes,” she said.

While voters are often called on to approve dedicated sales tax or property tax hikes, some communities have earmarked public money for early childhood in other ways.

In Breckenridge, for example, the town council initially allocated money for its early childhood program from the general fund, a move that didn’t require voter approval. Six years in, the town did ask voters for a property tax increase to support the program, but the measure failed.

The council subsequently decided to continue funding the effort as before.

In Elbert County, a partnership between early childhood leaders and county human services officials led to a special grant program that pays for preschool scholarships for low-income children stuck on the waitlist for state-funded slots.

Cathryn Reiber, coordinator of the Elbert County Early Childhood Council, said that in an ultra-conservative community where new tax increases would never pass, the county partnership has been a great solution.

Landrum, who heads the Denver Preschool Program, said it’s also important to win backing from the business community. After two defeats at the ballot box in the early 2000s, business leaders helped shape and endorse sales tax measures to fund the program in 2006 and in 2014.

In addition to providing preschool tuition assistance for the city’s 4-year-olds, the Denver Preschool Program provides training, coaching and materials for child care providers.

In some communities, funding for early childhood services is one piece of a broader package. In 2010 when the Great Recession was in full swing, Boulder County officials asked voters to approve a five-year property tax hike billed as a temporary safety net measure that would help families afford food, shelter and child care.

Voters said yes, and when officials came back to them in 2014 for a similar 15-year measure, they said yes again. The second time around, the campaign was called “Neighbors Helping Neighbors,” drawing on the community camaraderie that developed after the 2013 floods, said Bobbie Watson, executive director of the Early Childhood Council of Boulder County.

“You have to frame it so your community will bite,” she said.