Complexities emerging about possible tax implications of education savings accounts have at least one lawmaker urging the legislature to interrupt Gov. Bill Lee’s plan to launch the controversial program next fall, a year earlier than required by law.

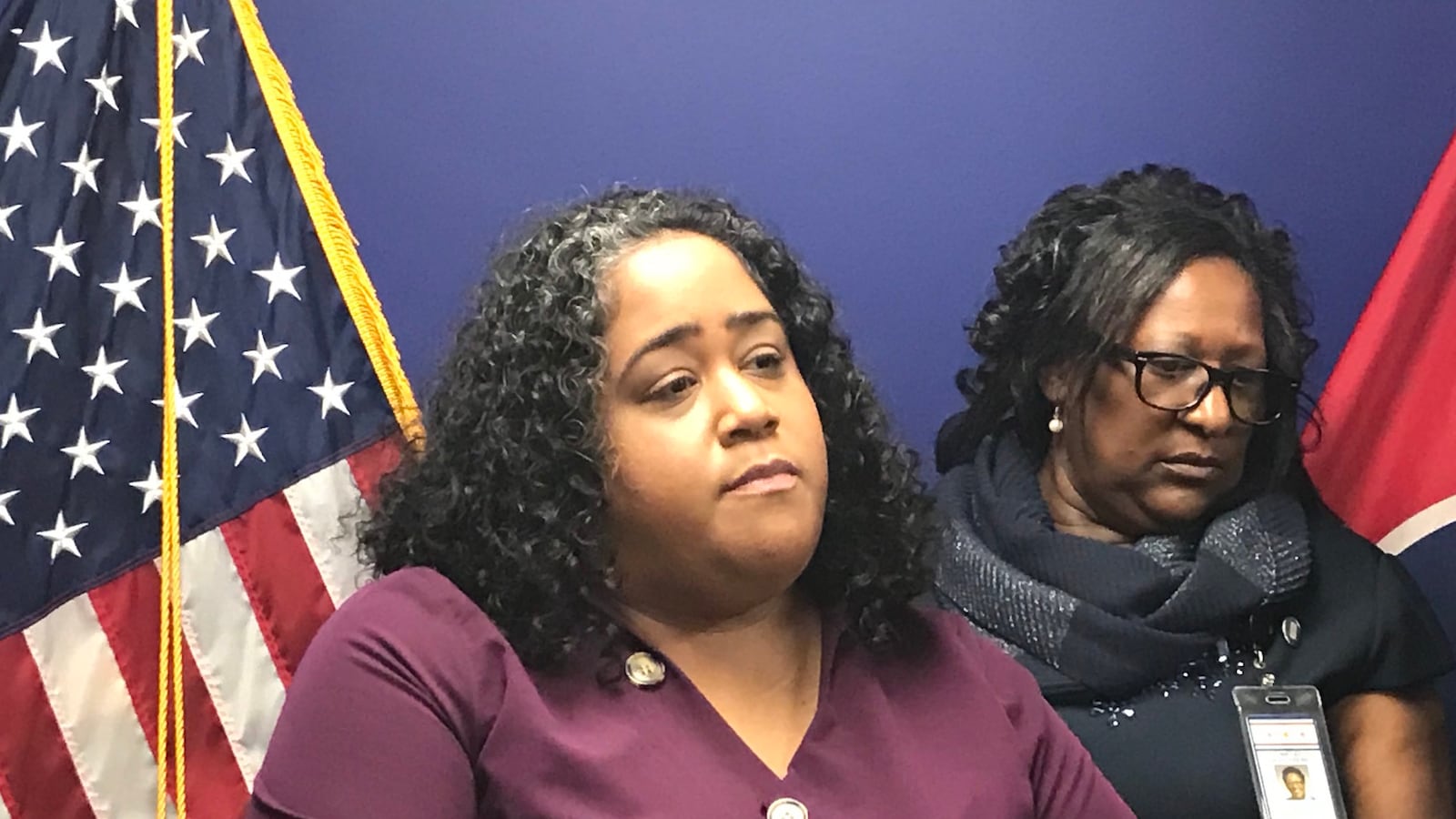

Sen. Raumesh Akbari called Tuesday for legislators to revisit the new law and work with the Republican administration to make sure the program isn’t rolled out before 2021.

Her comments came one day after Education Commissioner Penny Schwinn told the House Finance Committee that the voucher money would be counted as federally taxable income for families who enroll in the program.

That revelation — while disputed by at least one pro-voucher group — highlighted the complex issues that eligible families may need to work through when considering whether to pull their children out of public schools and accept an award of about $7,000 to pay for private school tuition or other private services. The additional income could increase some families’ taxes, bump them into a higher tax bracket, or even kick some off of entitlements such as TennCare, the state’s health insurance program for Medicaid recipients.

“The unintended consequences of the private school voucher bill are starting to stand out,” said Akbari, a Memphis Democrat who voted against the proposal. “There’s no reason to force this program into existence a year early if the end result hurts the very families it is supposed to help.”

The law gave Lee’s administration a two-year runway to develop and roll out the program, and most lawmakers — including new House Speaker Cameron Sexton, a Republican — were surprised this summer when Lee ordered the Department of Education to work toward an expedited timeline.

“The earlier we give a higher quality education to children in this state, the better,” Lee told reporters at the time.

The department has since been working to meet that deadline and recently hired several companies to develop application and payment systems. Meanwhile, the state Board of Education passed rules for the new program last week. And at least one lawmaker has filed a bill aimed at repealing the voucher law altogether before the program starts.

House Minority Leader Karen Camper, another Memphis Democrat, set the stage for the latest scrutiny during budget hearings on Monday when she asked Schwinn if voucher money would count as income on federal tax returns.

“My understanding is that this is taxable, yes,” Schwinn responded.

On Tuesday, department officials noted that Tennessee already sends reporting forms for federal tax purposes to recipients of its other education savings account program for students with disabilities.

“It would be virtually impossible for the department to know what the federal tax implications might be for a given ESA participant given the fact that each applicant will have a unique set of circumstances that might dictate the amount of federal taxes they pay,” said Jennifer Johnson, a spokeswoman for the department.

However, a spokesman for the pro-voucher Tennessee Federation for Children disputed statements from both Schwinn and her department.

“In the nearly 30-year history of private school choice programs (vouchers, tax credits, ESAs), across 26 states and D.C., the federal government has never deemed benefits received through these programs as taxable income,” the federation’s Gillum Ferguson wrote in an email to Chalkbeat.

The opposing statements point to the need for Tennessee to take more time to roll out the voucher program, said Akbari, who wants to ensure that families have accurate information and fully understand what that choice could mean.

“This is a major shift for Tennessee education and it’s important not to rush it,” she said. “If it took 12 years to pass a voucher bill so that we’re going to have a voucher program, why not take more time to make sure it’s at least done well.”