A bill to create a scholarship program to help Tennessee’s low- and middle-income families pay for high-quality early child care cleared its first legislative hurdle Wednesday — even as some lawmakers questioned whether funding child care should be the state’s responsibility.

The Senate Education Committee voted 7-2 to advance the legislation, which could tap up to $40 million annually in tax revenue from the state’s newly legalized sports betting industry.

Dubbed Promising Futures, the program would take a cue from Tennessee Promise, the state’s groundbreaking 2014 initiative offering high school graduates a chance at two years of tuition-free community or technical college.

If Promising Futures launches, Tennessee would again become a national leader in using lottery- or sports betting-funded scholarships to address a major workforce challenge, according to Max Altman, director of research and policy for the Southern Education Foundation.

“There’s a wide open space, especially in the South, for states to step in and take on the mantle of leadership to increase child care access,” Altman told Chalkbeat.

An early child care “crisis” is costing Tennessee parents, businesses, and taxpayers an estimated $2.6 billion annually in lost earnings and revenues, according to a 2022 study. And business groups from across the state have signed a letter urging lawmakers to create the new government scholarship program.

High-quality child care programs emphasizing early literacy also would help children become proficient readers by the third grade — a major focus of Tennessee’s education improvement strategy, said Sen. Becky Massey, a Knoxville Republican who is co-sponsoring the legislation with Rep. Mark White of Memphis.

“This bill will have a double bottom line, because it will strengthen our workforce of today and the workforce of tomorrow simultaneously,” Massey told the committee.

But several legislators who voted against the bill noted that, while Tennessee’s constitution guarantees “a system of free public schools,” it does not identify child care as a state obligation.

“I worry that this isn’t our role,” said Senate Education Committee Chairman Jon Lundberg, a Republican from Bristol.

He suggested that one reason child care is hard to afford is that the state added regulations in recent years that prompted many small, home-based child care businesses to close.

“Now we come back and say we have a huge problem,” Lundberg said, “and we’ve got to put in $40 million to solve this problem that we created.”

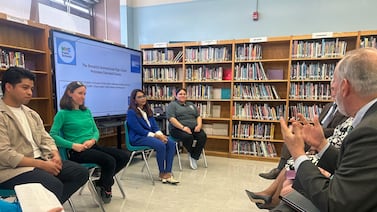

Leaders with Tennesseans for Quality Early Education, which is spearheading the Promising Futures initiative, said a review of regulations is appropriate — but so is a new investment to help children, parents, and employers.

Blair Taylor, the advocacy group’s CEO, noted that a 2022 survey of Tennessee parents with children under age 6 found that 80% reported employment disruptions due to inadequate child care, and nearly a fifth ended up leaving the workforce due to those challenges.

Tennessee legalized sports wagering in 2019 and collects 20% of the gaming industry’s adjusted gross revenues as taxes. Of that, 80% currently goes to the lottery fund used for higher education scholarships, 15% to the state to distribute to local governments, and 5% toward mental health programs.

The Promising Futures bill proposes starting the scholarship program with 60% of sports wagering tax revenues next year, increasing to 70% the following year, and 80% for each year thereafter.

But Lou Hanemann, chief of staff for the Tennessee Higher Education Commission, testified that diverting lottery money would be “devastating” to financial aid programs such as the HOPE scholarship, Tennessee Promise, and Tennessee Reconnect, which helps adults go back to school to gain new skills.

“I would strongly encourage caution in pulling away revenue streams that are coming in and being used directly for scholarship programs currently,” Hanemann told the panel. “This is not a reserve account where money is just kind of hanging out. The earnings off of these dollars directly fund scholarships every term for students.”

Sen. Raumesh Akbari, a Democrat from Memphis, pointed out, though, that sports betting is a relatively new revenue stream, beyond the Tennessee lottery created in 1974. She voted for the bill and has signed on as a co-sponsor.

At a legislative hearing in January, Mary Beth Thomas, executive director of Tennessee’s Sports Wagering Advisory Council, reported the state collected more than $68 million in sports betting privilege taxes in 2022, compared with $40.6 million a year earlier.

You can track the bill’s progress on the state legislature’s website.

Marta Aldrich is a senior correspondent and covers the statehouse for Chalkbeat Tennessee. Contact her at maldrich@chalkbeat.org.