Sign up for Chalkbeat Indiana’s free daily newsletter to keep up with Indianapolis Public Schools, Marion County’s township districts, and statewide education news.

Indiana House lawmakers on Thursday approved their version of the next state budget, sending the proposal to the Senate to consider how to shape education funding for the next two years.

The House draft is similar to the proposal first outlined by Republican Gov. Mike Braun earlier this year, including an approximately 2% annual increase in tuition support, which funds both public schools and private school vouchers.

But lawmakers have also restored funding that would have been cut to gifted and talented education and folded curriculum costs into the base funding that schools receive.

The budget passed over the objections of House Democrats, who called for universal eligibility for preschool vouchers, as well as more funding for traditional public schools.

But the Republican architects of the budget rejected their amendments, saying that they fund students, not schools.

“Public schools would get lots of money next year if parents chose to send them there,” said Rep. Jeffrey Thompson, author of the budget bill and chair of the House Committee on Ways and Means.

The Senate will now consider the budget. Senators have already passed property tax measures that will likely lower the property tax revenue available to schools, though not as much as an initial proposal by Braun. Those tax measures will now move to the House for consideration.

Here is where education funding stands at the midpoint of the legislative session.

Education budget changes textbook funding distribution

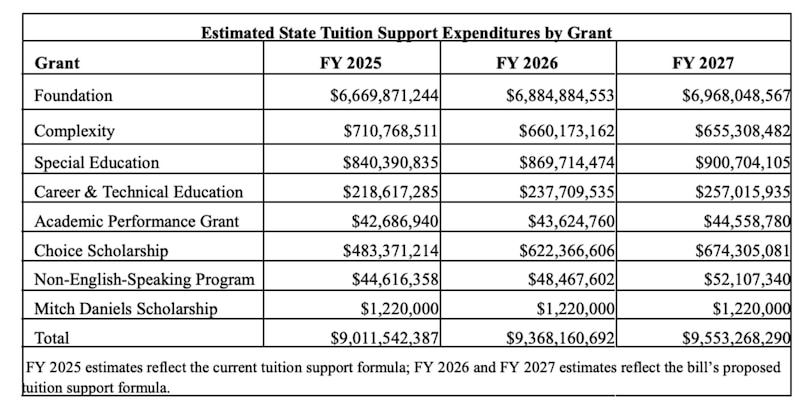

Republican lawmakers are still proposing an approximately 2% increase in tuition support each year of the budget, or around $180 million more in 2026 and $370 million more in 2027. This figure is in line with Braun’s proposed increase for tuition support.

But the total budgeted for tuition support in the new draft of the budget looks higher because lawmakers would like to roll the funding that schools receive for textbooks into the foundational amount schools receive for educating students. Thus the total budget for tuition support is $9.4 billion for 2025-26 and $9.6 billion in 2026-27.

Schools received $160 million for curriculum costs in 2025.

“By putting it in the foundation that’s going to grow as we grow the foundation throughout the years,” Thompson said.

This fund will also cover a proposal to make school vouchers universal for all families, regardless of income, which would cost the state around $89 million in 2026 and $95 million in 2027, according to an estimate from the Legislative Services Agency, or LSA. In total, the Choice Scholarship program is expected to cost around $622 million in 2026 and $674 million in 2027.

The graph below from LSA shows a breakdown of tuition support expenditures. Foundation amounts are the base funding that schools receive to educate all students, while complexity dollars go to students from low-income backgrounds.

Under the new budget proposal, the tuition support will also fund virtual students at 100% of the foundational amount, rather than 85% as is currently law.

In other education funding, lawmakers have proposed $86 million per year for the Freedom and Opportunity in Education fund, up from $25 million per year in the first draft of the budget. This fund is a new line item intended to give the state Department of Education flexibility to fund priorities, such as expanding the new ILEARN checkpoint test, operating the state teaching jobs board, and funding student learning recovery grants.

Furthermore, Gifted and Talented Education funding has been restored to $15 million per year after facing a cut to $13 million per year in the first draft of the budget. The second draft also adds funding to the budget earmarked for adult learners.

However, Republican lawmakers did not restore funding for the Dolly Parton Imagination Library despite calls from their Democratic colleagues to do so.

They have also kept summer school funding flat at around $18 million, though another bill will allow the Department of Education to differentiate funding for these programs based on the type and length of the course.

Finally, lawmakers are increasing the annual allocation for Education Scholarship and Career Scholarship accounts — two voucher-like programs used to pay for students with disabilities to receive services outside of schools and for high schoolers to take career training with private companies.

Both programs will each receive $15 million per year — less than the $25 million initially proposed for Education Scholarship Accounts, but more than the $11 million first proposed for Career Scholarship Accounts.

Revised property tax relief bill still affects school funding

Indiana Senators, meanwhile, have passed a property tax relief bill that mitigates the initial impact of Braun’s proposal to cap property taxes. That proposal was expected to cost schools and other local government entities around $1.2 billion in 2026 and up to $1.6 billion in 2028.

The revised Senate Bill 1 is now expected to cost these entities around $300 million in 2026 and $800 million in 2028. (Braun has suggested he would consider vetoing the bill if it doesn’t provide more relief to taxpayers.)

It may also have other effects on funding because it restricts the years that schools can hold referendums to general elections instead of both general and primary elections.

According to a revised report from the Office of Fiscal and Management Analysis, Senate Bill 1 would reduce funding to Indianapolis Public Schools by an estimated $1.2 million in 2026 and up to $2.9 million in 2028.

Other districts in Marion County are projected to lose:

- Beech Grove City Schools — $139,000 in 2026 up to $364,000 in 2028.

- Franklin Township Schools — $241,000 in 2026 up to $443,000 in 2028

- MSD of Decatur Township — $37,000 in 2026 up to $68,000 in 2028

- MSD of Lawrence Township — $33,000 in 2026 and $740 in 2028

- MSD of Perry Township — $60,000 in 2026 up to $492,000 in 2028

- MSD of Pike Township — $566,000 in 2026 up to $1.4 million in 2028.

- MSD of Warren Township — $338,000 in 2026 up to $759,000 in 2028

- MSD of Washington Township — $1.2 million in 2026 up to $3.1 million in 2028

- MSD of Wayne Township — $780,000 in 2026 up to $2 million in 2028

- School Town of Speedway — $71,000 in 2026 up to $166,000 in 2028

Senate Bill 1 has passed the Senate and will now move to the House for consideration.

Another bill, Senate Bill 518, also passed a final vote in the Senate Thursday. It requires districts to share some property tax revenue with charter schools. Property tax revenue funds schools on top of the state tuition support described above, and currently, only districts in a handful of counties must share some of this revenue with charter schools.

An amendment Wednesday delayed some of the sharing provisions until 2028.

But the Republican supermajority voted down several amendments by Senate Democrats that would have instead sent the issue to a summer study committee, required audits of charter schools receiving property tax revenue, or reduced the amount that charter schools receive.

Aleksandra Appleton covers Indiana education policy and writes about K-12 schools across the state. Contact her at aappleton@chalkbeat.org.